Issue #148 | 2026 Predictions

This year, instead of self-assessing, I took a different route: I asked ChatGPT + Gemini to assess whether each prediction made in last year’s article was correct or incorrect. Surprisingly, the results came back wildly positive: 24 out of 25 right. Not too shabby.

What I’m most proud of isn’t just the macro stuff – though calling the “soft landing” and exactly 3 Fed rate cuts was nice (both for bragging points and the portfolio) – It’s the specific marketing predictions that played out exactly as written:

- AppLovin: I predicted it would quickly establish itself as a viable channel (and take significant market share). It did.

- YouTube: I called it becoming the “safe haven” where ad dollars would go amidst the TikTok ownership/ban crisis. That’s almost exactly what happened – and it didn’t hurt that more marketers started realizing YouTube is still the most under-valued impression on the web today.

- Founder-Led Marketing: My overarching thesis has been that the companies that win will be the ones where the founder (or similarly-situated executive) truly owns communications and is willing to be in front, advocating for the organization. Put another way: the companies that embrace founder-led marketing will dominate those that default to milquetoast brand communications.

Trying to beat 24/25 is a high bar to clear, but I’ve been doing a lot of reflecting over the break, and I think the themes for 2026 are already becoming clear.

So, without any further ado, here is Part 1 of my predictions for the year ahead:

1. Ads in AIO (AI Overviews) Go Mainstream

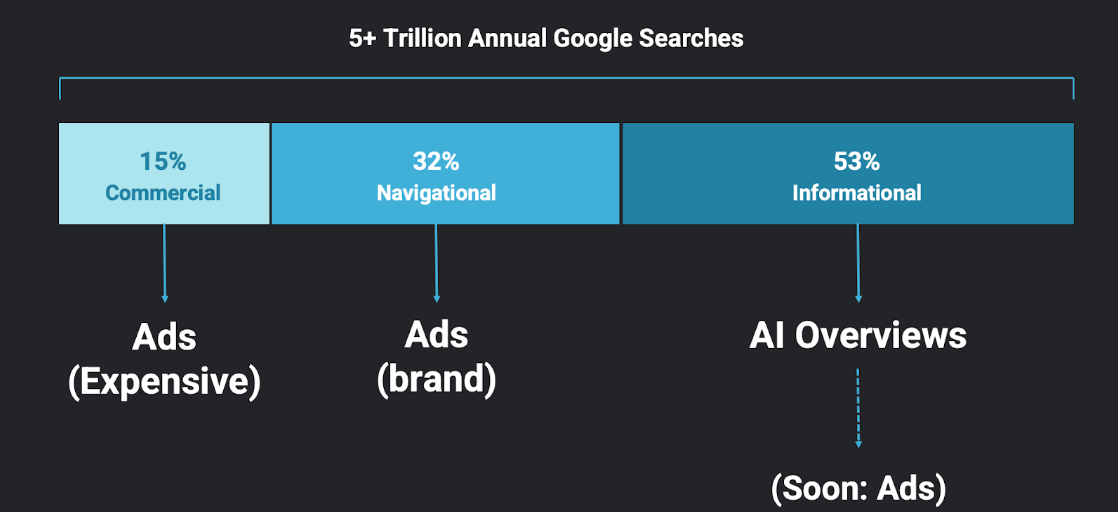

For the last 18 months, AI Search (like Google’s AI Overviews and AI Mode) have largely functioned as a SERP enhancement. Over the past year, the rates at which these features are deployed has increased markedly – from as low as 15% at the beginning of the year to 53% in November 2025. It’s clear Google sees both the value in integrating AI into standard search AND the revenue opportunity this presents.

Well, 2026 is the year AI SERP features become revenue engines for both Google AND brands.

Ad units will be integrated natively into these AI answers, specifically via “Shopping Tiles” (for eCommerce -adjacent searches) and “Sponsored Links” (for everything else), all embedded directly in the AIO.

Here is why this is a big deal: Historically, Google Ads monetized “commercial intent” (e.g., buy nike shoes) and “navigational intent” (e.g., Nike shoes). AIOs allow Google to monetize “informational intent” (e.g., best running shoes for flat feet). The problem? The vast majority of queries are informational! Monetizing AI overviews unlocks (potentially) trillions more search ad units every single year – that’s both a lot of potential revenue for Google (yes, I’m still long Google) and a lot of potential revenue for brands that can navigate the opportunity:

The data is already validating this shift.

In Google’s Q2 2025 Earnings Call, Sundar Pichai explicitly confirmed that AI Overviews are driving an increase in overall search usage and (crucially) a higher volume of commercial queries. Why? Because the user feels the product was “recommended” by the AI rather than “sold” by an advertiser.

My guess is twofold: (1) most advertisers are not budgeting for this and will find themselves overwhelmed by the organizations that are and (2) ad budgets will start flooding back to Google as 2026 progresses.

2. Marketers Shift Back to the “Big Screen”

Speaking of pendulums swinging back: I think the big screen is due for a big comeback. 2026 is the year marketers will see a significant budget migration toward Roku, CTV and linear TV, with total advertising investment projected to eclipse a record $38 billion in 2026.

My logic here is straightforward: the “Second Screen” (mobile) is saturated. The “First Screen” (TV) offers better stronger metrics, (arguably) better ad units (there’s only one ad at a time!) and – most importantly – the measurement infrastructure to back it up.

There are (in my view) 4 reasons why this shift is taking place:

- CPM Arbitrage: The flood of money moving out of traditional linear TV has finally caught up with ad networks. We have reached a point where big screen impressions are cheaper than social CPMs.

- AI Upscaling: The creative barrier to entry is gone. AI video upscaling now allows brands to take traditional “social” assets (even vertical video) and remaster them for 4K TV screens without losing quality and without making massive creative investments. The Big Screen is more accessible than ever before.

- The Prestige: This feels silly, but the effect is real (especially among older consumers who tend to have lots of money) – older consumers tend to associate TV ads with established, successful brands (primarily because – until this point – those were the only brands that could afford it).

- Democratized Measurement: Measurement has finally caught up. It is no longer just for the Fortune 500; AI-powered automated Marketing Mix Modeling (aMMM) tools have made it economical for smaller advertisers to calculate incrementality of TV budgets in single markets, often with less than $250k per month in spend. Less than a decade ago, the cost to merely run a MMM was $250k+.

And finally: TV is no longer just an awareness play. Tools like Roku Action Ads allow a user who has just been served an ad for a blender to press “OK” on their remote and instantly receive a checkout link via SMS. TV is becoming a performance channel, and the smart money is moving there.

3. The Line Between AI and Real Disappears

We are past the “Uncanny Valley.” Tools like Nano Banana (seriously…it’s scarily good) have shown us that AI video is quickly surpassing novelty status, rapidly approaching indistinguishable from reality. In 2024, you could spot AI video because the physics were off (hands morphing, gravity failing). In 2026, Nano Banana has “solved” physics. You can now generate a 30-second commercial that looks like it was shot on an Arri Alexa or RED KOMODO for (effectively) $20/mo.

But this goes far beyond just high-definition video clips. These tools are already here, and they are becoming sophisticated enough to replace entire production processes/workstreams – something I’ve seen first-hand as our AI initiatives have saved over 6,800 hours of time in just the last 6 months – which doesn’t include the hundreds of hours it’s saved my social team in chopping up whiteboard videos and the Marketing Uncensored podcast (shameless plug: we’re back for Season 2 in January!).

We are seeing the rise of features that solve the biggest headaches for product marketers: character consistency, product shot integration, and seamless video stitching. It means you can take a static image of your product, drop it into a scene, and have the AI render it with perfect lighting and physics, all while maintaining a consistent brand spokesperson across fifty different cuts. We aren’t waiting for the future; the tech is live, it works, and it’s about to get a whole lot more sophisticated.

4. Incrementality Measurement Goes Mainstream

For years, “Attribution” was the buzzword. In 2026, it will be replaced by “Incrementality.”

Over the past year, some of us have been quietly talking about platforms like Haus, that are leading the charge and bringing incrementality – traditionally reserved for brands with massive ($10M+) budgets and teams of data scientists – to the advertising masses. I think those conversations are going to get a lot louder and a lot more public in 2026, as more brands finally catch on that (1) attribution was always bullshit and (2) aMMMs are far better.

Here is why the shift to a robust standalone product is the critical piece of this prediction:

- The “Conflict of Interest” Problem: Most ad platforms (and even some attribution tools) operate on a model where they have a vested interest in showing a positive result so you keep spending. Relying on an ad platform’s built-in lift tool is like letting a student grade their own test. A standalone platform acts as an impartial auditor – it doesn’t care if you spend more or less; it only cares about the truth.

- Feature vs. Product: Many attribution platforms are scrambling to add “incrementality” as a checkbox feature. Usually, this is just modeled data (educated guesses based on algorithmic predictions). True standalone platforms run scientific holdout tests (geo-lift, exclusion groups).

- CFO-Ready Data: Attribution answers the question, “Who gets the credit?” Incrementality answers the question, “Did this actually generate net-new customers/revenue?” In an economy where efficiency is king, finance teams don’t care about ROAS (which can be manipulated); they care about lift.

Brands will stop asking “Did this ad get a click?” and start asking “Would this sale have happened without this ad?” This will be one of the biggest mindset shifts for marketers in 2026 – and the ones who will will be the ones who obsess about making ads that drive incremental sales/subscriptions/leads/revenue.

Bonus: the brands that make this switch will realize that 20-30% of their “best performing” spend was cannibalizing organic sales – and they’ll reinvest that cash into growth that is incremental.

5. Old School Ads Make a Resurgence

This is one that will make Rabah (if he even reads this) smile: I think polished, Ogilvy-style advertising is going to come back in 2026.

Now, this isn’t because the advertising industry gets all nostalgic, but rather because consumers/audiences are tired. The default for the past 36+ months has been TikTok-ified creative. Fast hooks. Quick cuts. Soundbites. Snippets. “Just ship it and test it.” And to be fair, it has worked. But there comes a point where it will not work any longer – and we’re approaching that point.

I’ve always said that surplus value decreases with adoption. Well, when the big legacy brands are pumping out TikTok-ified creatives, you can be pretty sure the late majority has arrived – which means the incremental gain from doing a thing is approaching zero.

When every brand is pushing ads that look like a piece of influencer content, it all becomes noise. Audiences catch on. It stops feeling natural, native and authentic, and it starts feeling like a template. At that point, the thing that stands out is the thing that feels intentional. Polish, done right, is intention made visible.

Take Chevy’s recent “Memory Lane“ commercial as the blueprint. It’s not selling features; it sold a feeling. It was pure storytelling that broke through the noise because it felt human in a feed full of noise.

You’ll see this swing back hardest in categories where trust matters: Finance. Healthcare. Legal. Home services. In uncertain markets, people want signals of stability. A well-made ad, with a clear proposition and proof, quietly communicates that the company is serious and likely to be around in two (or twenty) years.

That’s the irony of 2026 creative: as AI plays a progressively larger role in creative, it’ll be the brands that leverage it to become more human that win. AI crushes the cost of production; humans with real perspective, real spine and real taste ensure the production is worth making. In an AI-driven creative world, the most human brands win.

6. CPM Inflation Bifurcates

Traditionally, when CPMs go up, marketers treat it like inflation: a cost pressure felt everywhere. In 2026, this changes. My prediction is that CPMs will stop being just a cost metric and start acting as a proxy for attention and placement quality.

We are going to see a “K-Shaped” split in the market. “Junk inventory” (Made-for-Advertising sites, click-bait farms) will see prices crater, while high-attention, high-quality placements will command premium pricing. Cheap will get cheaper; quality will get expensive.

The clearest example of this is the Google Display Network (GDN). While costs for high-impact formats like CTV or YouTube Select are climbing, open-web display CPMs remain suspiciously flat (or are even dropping). Why? Because the market has priced in the lack of attention. Buying cheap inventory isn’t “efficient” anymore; it’s largely invisible. You might get a $1.50 CPM on a sidebar banner, but if it takes 10,000 impressions to get one second of actual human attention, it is actually the most expensive media you can buy.

This marks a fundamental shift in how we buy media. For the last decade, the goal was “reach” – casting the widest net for the lowest cost.

In 2026, the alpha moves to placement curation.

Media buyers will need to stop acting like stock traders (chasing the lowest price) and start acting like art curators (selecting the best environments). Success won’t come from finding the cheapest CPM; it will come from ruthlessly filtering out the “junk” to ensure your brand only appears where real humans are actually looking. The days of “set it and forget it” programmatic buying are over; active inclusion lists are the new standard.

7. Marketing Teams Get More Integrated

The default model for marketing is moving toward smaller teams and smaller, more integrated agencies.

The days of a mid-sized brand managing 5+ specialized agencies – one for SEO, one for PPC, one for Creative, one for PR – are drawing to a close. Why? Because the “Specialist Era” created a massive coordination tax. It turned the CMO into a project manager instead of a strategist, and it turned brand strategy into a game of telephone where the message got garbled between the “TikTok Agency” and the “Email Team.”

Brands are realizing 2 critical truths:

- Cohesiveness > Specialization: A unified voice across 3 channels performs better than 5 disjointed-but-optimized-perfectly-for-the-platform ones.

- Speed Wins: It is infinitely easier to move fast when you aren’t waiting for 3 different external partners to get their stuff together.

The “Golden Model” for 2026 is a small, talented in-house team supported by a single, integrated, full-service partner.

Historically, the knock on full-service agencies was “jack of all trades, master of none.” AI changes this. It allows integrated teams to execute technical tasks at an elite level without needing a siloed department for each.

We are entering the era of the “Elite Generalist.”

This is a shift away from the “Assembly Line” model of marketing (where an idea passes through 5 layers of bureaucracy on its way from genuinely clever to perfectly adequate). In 2026, organizations will flatten. The winners will be the brands that empower small, agile squads to make decisions and ship.

In a world where AI levels the playing field on quality, speed becomes the core differentiator. The brands that win will be the ones that can break things, fix them and ship again before their competitors have even finished scheduling the kickoff meeting.

8. Brand & Storytelling Become Central to Growth

This is self-explanatory, but critical. As algorithms automate the “math” of media buying, the lever for performance moves back to the “magic” of the message. Growth in 2026 won’t come from silly growth hacks or platform exploits; it will come from having a story that people actually want to hear.

2026 marketing becomes a race to be more human while embracing AI.

The central paradox of 2026 is this: To win in an AI-first world, you must become aggressively human.

As AI models commoditize “competence” – giving every competitor the ability to write decent copy, generate clean images and optimize bids – the baseline for quality has been raised, but the ceiling for differentiation has been lowered. This is the “explosion of mid” I talked about in those AI issues: when every brand sounds “professional” and “optimized”, the risk becomes drowning in a sea of sameness.

The winners will be the brands that use AI to handle the logistics so they can double down on making real, human connections. This means embracing a distinct point of view, specific storytelling and the strategic flaw that proves a real person is behind the message. In a feed dominated by synthetic perfection, raw humanity is the only un-hackable moat.

Aside: one inevitable consequence of this is that more brands will become more overtly polarizing – because marketers are finally coming to the realization that the Middle is the worst place to be. I expect to see more brands take stands – not necessarily political, but purposeful.

9. The Finance-Marketing Gap Closes

For top-performing brands, the wall between the CFO and the CMO is coming down. Having a CRO or CFO intimately involved with marketing operations becomes the norm. This is directly tied to the shift toward incrementality (Prediction #4). As marketing data (finally) begins to live up to the decades of promises & becomes financially stable, finance teams are willing to get in the trenches.

10. Brands Incubate Their Own Influencers

Finally: 2026 will see more brands move away from renting influencers and start incubating their own. There are plenty of reasons for this, but it comes down to 4 big ones:

- Cost-Effective: it’s so much cheaper for brands to develop their own influencers than it is to continually “rent” a set of them – especially when the brand has already invested so much in understanding a specific target market.

- Offense + Defense: having multiple brand-developed influencers allows for more flexibility in content + deployment. while a traditional “influencer” might not be willing to focus on certain elements of your product/service, or might be unwilling to criticize a competitor, those same limitations don’t apply to brand-developed influencers.

- Recruitment: I genuinely think one of the greatest recruiting advantages a company can have in today’s market (especially for GenZ and soon-to-be Gen Alpha) is the infrastructure to build personal brands. I’ve seen it first-hand – the willingness to help prospective employees build a platform is a MASSIVE differentiator. If you want elite talent, this is one of the easiest ways to get more of it.

- Brand Protection: finally – one of the best advantages is that it de-risks the transaction for the brand because you know who’s behind it. You’ve done your due diligence on your hire. You know the person behind the account.

I wrote a long article about this trend over a year ago – if you’re curious, it’s worth a read.

11. New Platforms Finally Emerge As Viable

For the better part of a decade, the “Duopoly” (Google/Meta) was the only digital game in town if you wanted scale. You paid the toll, or you didn’t play. The result? For much of the last ~7 years, there’s been a concerted effort to break the duopoly – first with competition, then with regulation – neither of which were successful. But, just as with 15th-Century castles, sometimes breaking the monopoly means opening a new trade route that goes around the impregnable fortress, instead of trying to bulldoze through it.

2026 is the year where some of those “alternative routes” become viable (as in: brands can spend $50k+/mo on each one at or below your target CPA / above your target ROAS):

- X Ads: Reports of its death were greatly exaggerated. Love it or hate it, X remains the pulse of real-time culture. The ad product has stabilized, the cost is wildly attractive and for brands that can stomach the “wild west” nature of the feed, the attention is underpriced. It doesn’t hurt that X is the only major social media platform where many of the “people who make things happen” in tech/culture/politics are active (where else can you find the owner of the Mavericks debating healthcare policy with sitting members of Congress, while the world’s richest man pops in for a comment?).

- Reddit Ads: One of the side effects of Google’s massive investment in Reddit was an explosion in organic traffic to the platform (6x+) – primarily driven by exponentially higher visibility for research/discovery/problem/solution-oriented queries. Where that gets interesting is that advertisers haven’t followed, which means attention is underpriced. The trick to making Reddit ads work is to be on Reddit before advertising – have your own Subreddit. Encourage existing thought leaders/influencers to participate in relevant communities with thoughtful, human posts. Add value as a brand to those communities, too. Rack up some Karma. Then – once you’ve built some credibility – start to advertise. This is a long game – but the brands that nail it will reap outsized rewards.

- YouTube Ads: As I mentioned in Part 1, far too many brands are still sleeping on YouTube. It is more than just a safe haven – it’s the single-most undervalued impression on the internet. If you’re not thinking about how to leverage YouTube in 2026, now would be a great time to start. If you’re not sure how to do that, check out this article.

12. The Creator Economy “Re-Professionalizes”

The “anyone can be a creator” myth is (finally, blissfully) dying. There is a massive squeeze on the “middle class” of influencers – brands are (rightfully) no longer willing to shovel money at middle-of-the-pack creators with fair-weather followings and little-to-no ability to influence action. The days where a person could make a full-time living with holding up an iPhone and unboxing a package are ending.

The shift in 2026 is toward professionalization – both from creators AND from how brands choose those creators.

On the creators: the winners won’t just be “creators”; they will be small media businesses with taste, perspective, production teams and editors. And just as media businesses advertise their style and audience, so too will creators – we’re going to start to see more creators proactively sharing their media kits, audience analysis and campaign/partnership results.

On the brands: the days of brands selecting influencers based on a few IG posts are drawing to a close. The infinite money influencer glitch has been patched. Brands are demanding results from their creator spend – which means those same brands are now investing more time, money and energy researching + understanding the people with whom they partner. This is the natural extension of the SparkToro trend: a significant portion of the value of a creator is tied to their ability to influence a particular audience. Expect to see more brands using tools like SparkToro to do exactly that.

Finally: the “big thing” for creators in 2026: aesthetic. The NY Times (love them or hate them) has a vibe. An aesthetic. A style. So does Mother Jones. The Heritage Foundation. Scott Galloway. The All-in Pod. Brands will be increasingly attracted to creators that have a unique voice/perspective/aesthetic that is difficult to replicate.

Ultimately, brand’s relentless pursuit of those three things – professionalism, aesthetic, influence – is what will crush the mediocre middle of the creator class.

13. The Era of Aspirational Marketing Is Upon Us

The pendulum is swinging back.

For the last decade, marketing was dominated by a cautious, corporate version of virtue: everything is beautiful, everyone is included, no edges, no hierarchy, no aspiration. It wasn’t always wrong – but it made brands blur together.

2026 is the year brands remember a truth that never stopped being true: People don’t buy brands that reflect who they are; they buy brands that reflect who they want to become.

And that means aspiration is back – not in a cheap, early-2000s “sex sells” way, but in the more powerful, more enduring sense:

- beauty

- status

- taste

- exclusivity

- physical excellence

- aesthetic coherence

- Being part of an “in” group

This shift is already visible everywhere:

- Fashion: the leaner silhouette is back. High-waisted is fading. Athletic and tailored is back in vogue. See brands like Alo, Brandy Melville, Urban Outfitters

- Fitness: “strong and lean” is the new social currency. Pilates, weights, HIIT – not as hobbies, but as a core part of identity

- Pop culture: the movie star is back (see: Sydney Sweeney, Taylor Swift/Travis Kelce, The Hemsworth Brothers). The glamour era is back.

- Health: the GLP-1 revolution isn’t just changing waistlines; it’s changing the definition of normal. For what feels like the first time, weight loss is attainable without massive sacrifice (well, at least in the short term).

2026 is the year brands realize they cannot be everything to everyone. The attempt to be universally inoffensive is no longer a growth strategy.

Instead, we’re going to see a resurgence of aspirational advertising:

- more beauty

- more polish

- more “this is what winning looks like”

- more selective identity signaling

- and yes – more attractive people, because attractiveness is still the world’s most underpriced form of attention

Important nuance: this isn’t about being provocative for clicks. It’s about moving away from “relatable” as the highest virtue and returning to the real drivers of demand: desire and distinction.

If I’m right: you’ll see more brands shift from “inclusive relatability” toward “exclusive identity,” and it will outperform – especially in fashion, wellness, luxury, consumer tech and high-end services.

If I’m wrong: it’s because platforms and PR departments continue to punish aspiration as “exclusion,” and brands stay trapped in bland universality. But I don’t think I’m wrong, and I don’t think this happens.

14. Cyborg Structure For Ads

Marketers are (rightfully) distrustful of platform-led optimization. On one hand, we’ve all experienced what happens when you let the “black box” spend money without supervision: it tends to find the path of least resistance, not the path of highest profit. On the other hand, we can’t ignore the power of machine learning – there’s a reason Google + Meta are two of the greatest commerce engines ever created.

The Prediction: The winning structure for 2026 is “Cyborg Media Buying.” Expect to see brands leaning heavily into “AI-powered” targeting (Broad match, Advantage+), BUT only with robust controls on the buying side. We aren’t fighting the machines; we are building better machines (agents, automated rules, scripts) to police them. The goal is to use AI for scale, but human-defined logic for guardrails.

15. The “Realness” Rail (Trillion Dollar Opportunity)

2026 will be the year the internet breaks a little – because AI becomes too good.

AI content will flood every screen/surface: ads, reviews, social feeds, search, customer support, even “user-generated content.” And by the end of the year, AI-generated video and images will be good enough that the average consumer cannot reliably tell what’s real. No more six fingers. No more phantom limbs. No more obvious tells.

That means the most valuable digital asset becomes something we haven’t needed at scale before: proof of origin.

Brands are going to realize something anyone who has played a strategy game has always known: detection is a shield. Shields always lose in arms races. For every detection model, there’s a generation model trained to bypass it. So, the defense can’t be “spot the fake.”

Instead, the defense becomes: prove it’s “real”.

In the same way the internet needed SSL certificates to prove a site was secure, and payment networks to prove a transaction was legitimate, we’re about to need a trust rail to prove that an image, video, voice clip or document was created by a real human (or a disclosed AI), unchanged since creation and attributable to a verified source.

This starts in the obvious places, like political advertising, celebrity deepfakes, financial scams, fake reviews, synthetic customer service – but it won’t stay there. Once consumers are trained to doubt everything, verification becomes a default expectation everywhere.

2026 is the year “Verified Real” becomes the next layer of the internet.

The winners won’t just build features. They’ll build infrastructure: provenance standards, device-level authenticity capture, cryptographic signing, and the UX layer that makes trust visible at a glance.

Now the marketing implication: Brand safety expands beyond “don’t appear next to bad content” to “prove to your customers it’s actually you.”

When anyone can generate a perfect imitation of your CEO, your product, your ad, your reviews and/or your support team, trust becomes currency and authenticity becomes a competitive advantage.

If I’m right: by Q4 2026, you’ll see “verified” signals for media rolling out in the wild (platform-native, device-native, or browser-native). Brands will start promoting authenticity the way they once promoted security.

Either way, the destination is the same – in an AI-saturated internet, realness isn’t an aesthetic or a nice-to-have; it’s critical infrastructure.

16. Subscription Fatigue & The Great Re-Bundling

Consumers have had enough. They are suffering from “death by a thousand charges.” They are tired of a subscription for their toothbrush, their socks, their razor and 15 different streaming services. I just purchased a HP Printer, only to find out that I must also pay for an “HP Ink” subscription if I want to use manufacturer-standard ink (and if I don’t, no warranty). When printers, socks, razors, garage doors (MyQ) and video games all require subscriptions, you know we’re probably close to a top in the market.

We are at the end of the unbundling era. As the old saying goes: “There are two ways to make money: you can unbundle, or you can bundle”. In 2026, the money is in the bundle.

- Membership, not Bill: Brands must learn to sell the subscription as a “membership” with perks (think Costco or Amazon Prime), not just a monthly charge.

- Churn is Relationship Management: Brands will learn they can’t resort to pricing gimmicks to keep customers around and happy; they must constantly create and message the value provided by the subscription.

The Super-Bundle: Expect to see strange bedfellows. Brands will band together (think Disney-ESPN-Hulu) to increase perceived value and reduce churn (yes, Silicon Valley is about to re-invent cable and call it something revolutionary – what’s old is new again).

17. Loyalty Programs Evolve Into Status Symbols

I tend to think airlines and credit cards are good bellwethers for where the rest of the loyalty market is going. 2025 saw multiple loyalty programs re-designed to revert to their original purpose: Status Symbols – think: the overhauls of American Express Platinum & Chase Sapphire Reserve cards, plus the major cuts to Delta Skymiles + American Aadvantage programs.

Those were the first dominos, but they will not be the last.

Brands will move away from exclusively discount-focused programs (which just trained customers to wait for a coupon) and focus on membership, community and belonging.

Why?

Because those examples above demonstrated that status-based loyalty increases retention without eroding margins. Giving a customer “Early Access” or “VIP Treatment” creates a feeling of exclusivity that adds value, whereas giving them “20% off” erodes margin for no incremental benefit.

PS. Brands will also figure out that giving existing, high-value repeat customers who were going to buy anyway discounts is one of the dumbest things you can do. The better move? Save the discounts for net-new acquisition and reward the loyal customers with exclusivity/access (which you can make more and more expensive).

18. Marketing Becomes “Moment Engineering”

A related point to #17: the days of “smash the sale button to make money” are ending. Supply-side margin pressures mean brands simply cannot afford to be on sale forever. 2026 is the year Marketing Strategy makes a big comeback.

This will manifest as Moment Engineering: the art of creating commerce moments where consumers naturally want to interact with the brand, rather than just waiting for a discount code. Think Prime Day. Think Spotify Wrapped. These are engineered moments that create massive demand spikes without relying purely on clearance pricing.

The brands that can engineer these moments – whether it’s tying into existing (if under-appreciated holidays), timing new product drops, partnering or leveraging other major events (think the Big Game, Olympics, etc.), or piggybacking on existing trends (i.e. homebuying season) – will reap outsized rewards.

19. Community-Centric Marketing (The “Dark Social” Shift)

There has long been value in creating niche communities, but in 2026, this takes on an outsized role – particularly for high-stakes purchases (both B2B + B2C).

One of the trends I’ve monitored for the last 2 years is “dark social” traffic, via multiple experiments on both my site and our agency website – visiting from private Slack chats, X direct messages, text chats, LinkedIn messages, Clariti, Discord, etc. – and virtually all of the visits are bucketed (direct). At the same time, the share of traffic from (direct) is increasing – which (likely) means one thing: more people are making more decisions based on non-public social interactions.

This is “Dark Social” – traffic that comes from a quasi-social source, is near-impossible to track, but has sky-high commercial intent.

Marketers who engineer consistent, predictable ways to participate in these communities (or facilitate them via experiential marketing/private meetups) will be at a massive advantage. I fully expect to see more effort (especially audience insight/research) focusing on identifying what communities key constituencies participate in, then finding ways to engage (likely indirectly).

20. LLMs Become A Viable Revenue Channel

We’ve tracked this for the last 6 months, and I am confident that 2026 is the year LLMs (ChatGPT, Gemini, Claude) become viable channels for both lead gen AND commerce.

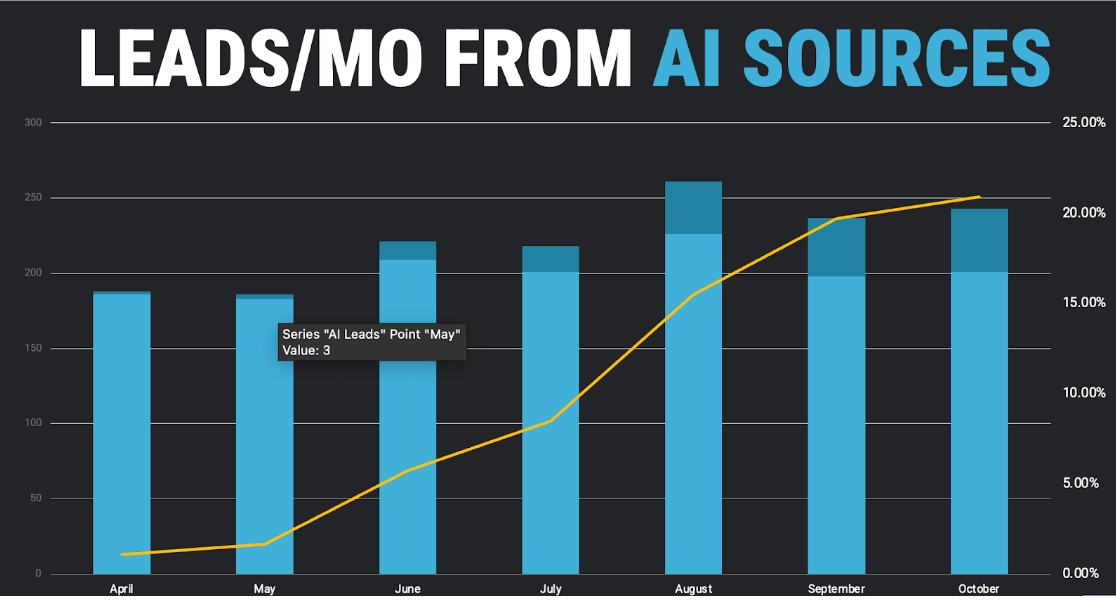

The chart below shows the total volume of leads for a brand over 7 months in 2025 (I was lazy and wanted to wait until January to update this, so we have all 2025 data in) – the light blue is non-AI leads; the dark blue is leads from AI sources. The yellow line shows the share of AI leads. This is not a particularly large site/business (it’s a B2C lead gen business that’s averaged ~150-200 leads/mo) – but you can see two things: (1) the share of AI leads has exploded – from <5% to >20% in just 7 months and (2) many of those leads are incremental.

That data aligns with the quantitative and qualitative data we’ve acquired over the last year: consumers are no longer just asking ChatGPT for summaries; they are asking: “What is the best running shoe for flat feet?” or “Plan a 3-day itinerary for Tokyo.”

If your brand isn’t appearing in those answers, you are invisible to a massive, high-intent segment of buyers. “LLM Visibility” (GEO – Generative Engine Optimization) is the new SEO. If you’re curious how to do that, check out this article.

21. The BNPL Reckoning

Buy Now, Pay Later (BNPL) is going to face a massive reckoning in 2026.

Let’s be honest: These companies were never well-underwritten, and consumers are realizing these are some of the most expensive terms around.

As defaults increase, merchants will be forced to either (a) raise prices to cover the fees or (b) stop offering the most expensive BNPL options. It’s a vicious cycle, and the bubble is about to burst.

22. The Bifurcation of the Young Consumer

There is a massive split happening in the younger US consumer base, driven by two different flavors of economic nihilism:

- The “Dave Ramsay/Caleb Hammer” Crowd: These consumers are turning to extreme savings, “loud budgeting,” and “act your wage” mentalities. Marketing to them requires rational, long-term, value-based messaging.

- The “High-Stakes” Crowd: The other half is turning to pseudo-gambling as an escape: Robinhood options, Crypto, Supercar Giveaways, Sports Betting, OnlyFans, Pokemon Card hoarding….it’s (basically) a more aggressive take on “get rich or die trying”

Why This Matters For Marketers: brands cannot use “middle-of-the-road” messaging anymore – you’re either selling fiscal responsibility and longevity, or you’re selling instant gratification and the dopamine hit. Pick a lane.

23. The Anti-Scam Economy

A major political and cultural issue in 2026 will be protecting consumers (and vulnerable groups) from the (very real) harms that can come from AI. Just in the last few weeks, we’ve seen women being undressed by AI on social media, companies using AI to “fake” reviews and prevalent AI scams targeting some of society’s most vulnerable groups (especially the elderly).

Those negative headlines, plus the fact that the midterms are on the horizon and boomers being the highest-turnout voting bloc in the US means one thing: AI regulation will be on the ballot.

But – this isn’t something that regulation alone will solve. New tech like Google’s SynthID help, but something bigger is needed (and likely coming) in 2026. Brand Safety now means ensuring your customers know it’s actually you.

Trust is currency. Tools that help brands prove to their audience that it’s actually them will become more important than ever.

24. The Intergenerational Wealth War

Let’s get to the other big, tectonic reality that is going to re-shape the commerce + cultural landscape (to borrow a phrase from the Future Commerce team: Commerce Is Culture): “American Dream” is collapsing for younger generations. The fallout is creating a massive divide – American society is (effectively) ceasing forward-looking investments (R&D, education, innovation, infrastructure) to finance progressively larger payments to retirees (social security, medicare, the associated interest).

Why this matters for marketers:

- Older Consumers: They have the assets. They are the key customer base for luxury goods, real estate, travel and professional services.

- Younger Consumers: They are necessary for the workforce but are struggling with rent and inflation.

For the first time in American history, children are not doing as well as their parents. This was a peripheral theme in the 2024 elections – but for 2026, it comes front-and-center. And in our politics-is-culture-is-commerce era, that means this is an issue that brands will need to navigate – though I think most will struggle with figuring out how to appeal to a Boomer with disposable income without alienating a Gen Z worker who feels the system is rigged.

25. The “Human” Authenticity Score

Expect to see companies developing tools (similar to Moz’s Domain Authority) that rate sites/accounts based on how human they are. In a world flooded with AI slop, a high “Human Score” will become a trust signal. We will soon see “Verified Human” badges becoming as important as SSL certificates were in the 90s/00s.

26. Distribution Becomes The New Creation

One of the major themes of my predictions this year is that as the cost of creation collapses (thanks to AI), the big question more brands must answer is no longer “how do we make content?”

It’s how do we create something so staggeringly valuable it’s worth distributing – and then, how do we distribute it where our audience will find, share and use it?

In 2026, creation is no longer the bottleneck. Distribution is.

For most of the last decade, brands treated distribution as an afterthought. You made something, posted it, maybe boosted it, maybe crossed your fingers and hoped that Field of Dreams was right (create it and they will come) when the platform algo did its thing.

The market rewarded “consistent output” because output itself was hard. But AI changed that.

In the last 3 years, Gen AI has made creation faster, cheaper and abundant. And abundance does one thing to markets: it destroys the value of the abundant thing and shifts value to whatever is scarce.

So, in a world where everyone can create, the competitive advantage moves to:

- Taste (what you choose to create)

- Credibility (why anyone should believe you)

- Distribution (how you get it seen, shared, adopted)

Creation is table stakes. Distribution is the only moat – though not all distribution is created equal. The brands that win won’t just “post more.” They’ll build distribution moats – durable channels that act as a distribution flywheel, with pieces of content becoming easier to launch, spread and leverage (i.e. drive value for the organization) over time.

I think there are 5 moats that matter:

1) The Direct Line Moat (Owned Audience)

Email lists. SMS lists. Push notification subscribers. App users. As social feeds are flooded with generic stuff, direct access becomes progressively more valuable. If you can reach your audience without renting attention from Meta/Google/TikTok, you’ve already won half the battle.

2) The Community Moat (Trust Infrastructure)

Slack groups, Discords, subreddits, private chats, customer groups, in-person meetups. Communities are where high-intent decisions get made and recommendations are exchanged – mostly off-platform, mostly untracked and massively influential. Community shifts from pure brand building to distribution.

3) The Creator Network Moat (Distribution Nodes)

Not “influencers you hire.” Creators you build (or build repeatable partnerships with). The best brands will stop treating creators like one-off media buys and start treating them like a network – a repeatable system for reach, credibility and relevance. I think the go-to structure becomes a hybrid – some “built” influencers, some “partner” influencers, some brand-led campaigns.

4) The Syndication Moat (Cross-channel Repurposing That Doesn’t Feel Like Spam)

One strong idea expressed 10 ways across 10 formats/channels: podcasts, newsletters, LinkedIn, YouTube, Reddit, X, short-form clips, sales, PR and community marketing. The winners won’t just create content; they’ll create content that can be reliably distributed to the places where their customers are likely to be.

5) The Authority Moat (Citations + LLM Visibility)

Authority is shifting from something nice-to-have to something essential. LLMs will continue to reward unique excellence (i.e. content only you can make that is better than anything else on the internet) because *that’s how models get better*. The brands that produce research, benchmarks, tools, frameworks and credible expertise will be the brands that get cited, recommended, and surfaced by both humans and machines.

The takeaway is simple: In 2026, the competition is shifting from content to distribution. The brands that build those systems will turn AI into a force multiplier that accelerates their growth in ways we can’t imagine. Everyone else will be left behind.

That’s a wrap on the crystal ball for this year.

Cheers,

Sam